Destination Saas-Fee

Placeholder text: Saas Fee, surrounded by 13 peaks

that reach a heigh of over 4000m.

Geography

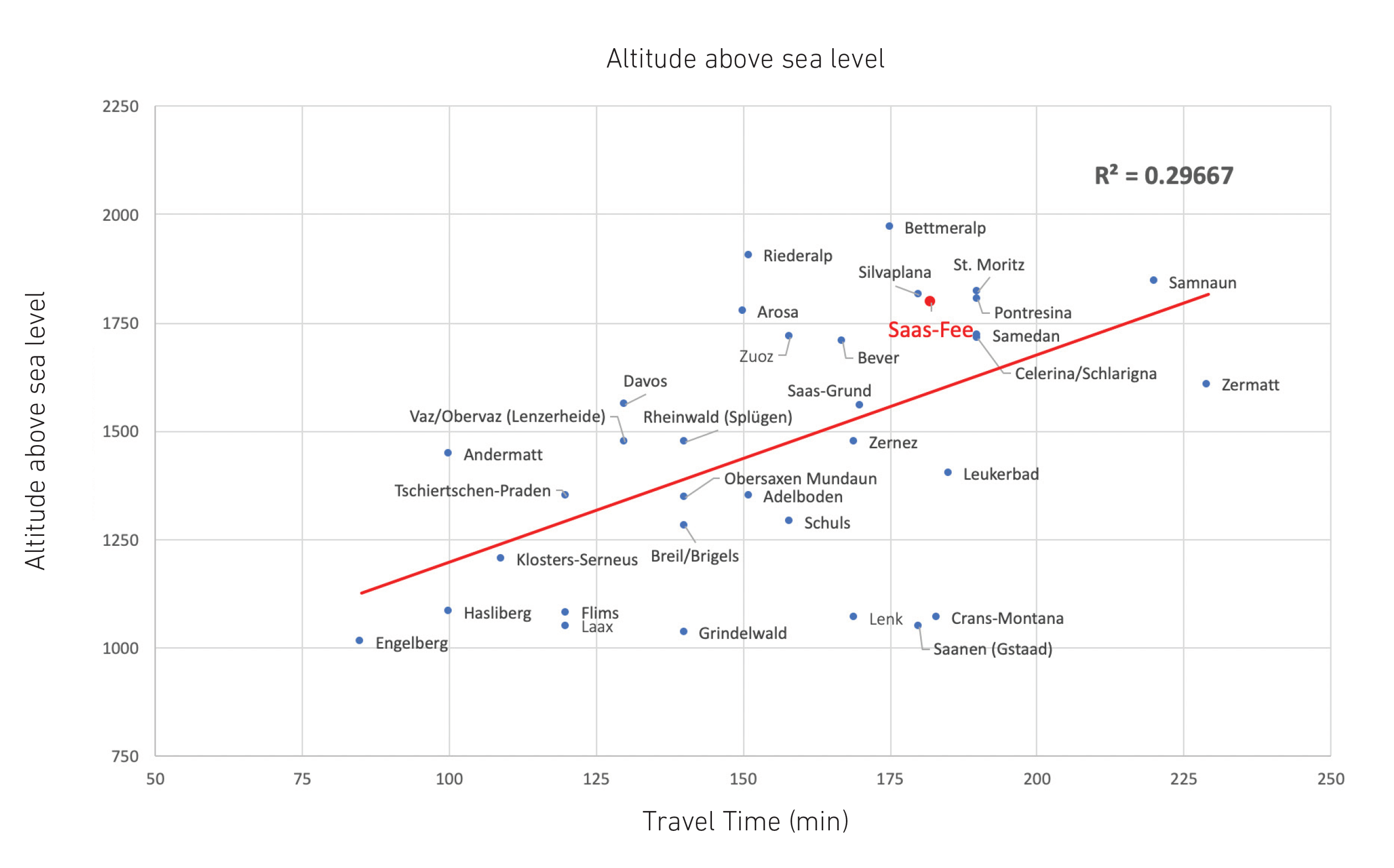

Saas-Fee is situated on a high plateau in the Saas-Valley, West of the valley floor and above the neighbouring villages of Saas-Almagell, Saas-Grund and Saas-Balen. It is the main village of the four communities. Saas-Fee is surrounded by the Mischabel range, which boasts 13 peaks that each reach a height of over 4000 meters above sea level, offering unique panoramic views. They have made the village famous as the “Pearl of the Alps”.

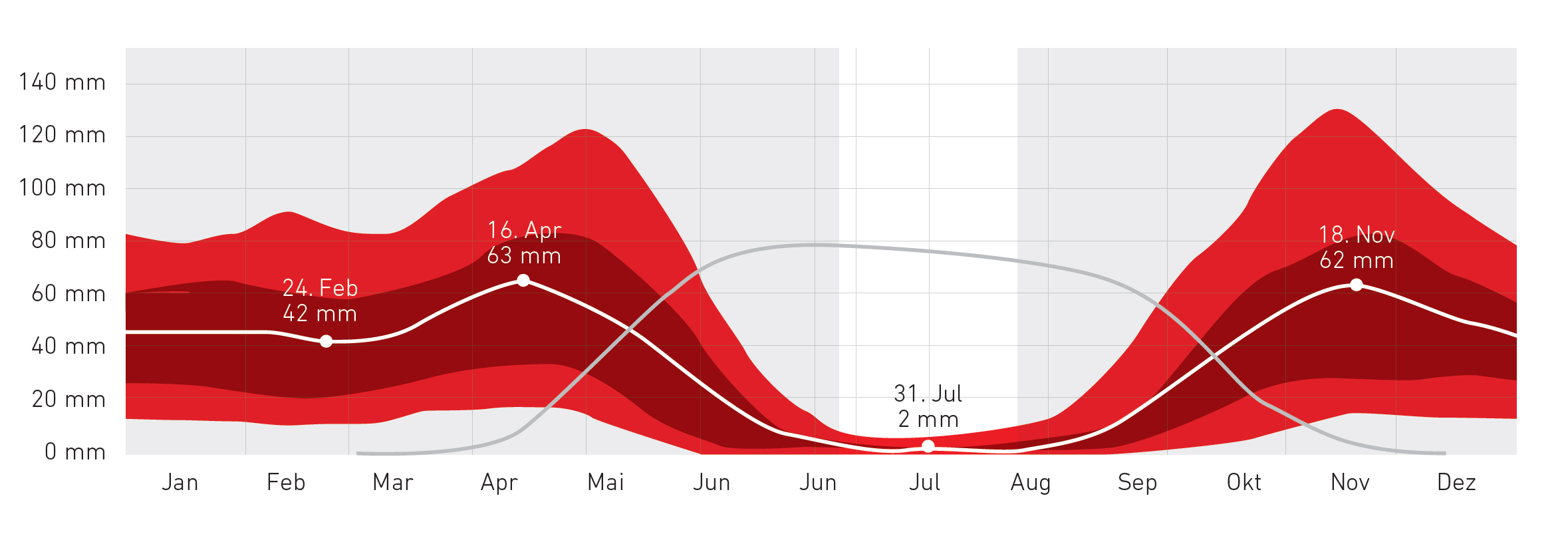

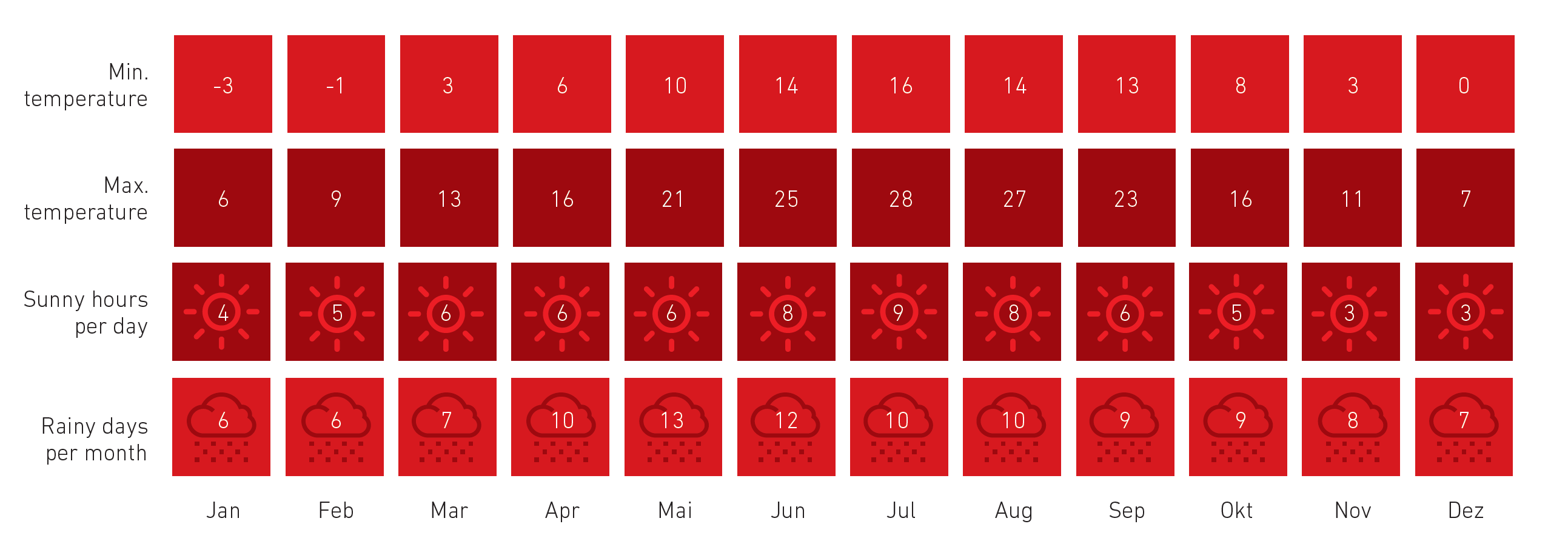

The geographically favorable location of the Saas-Valley creates a micro climate that makes it sunnier than other parts of Switzerland. Temperatures are generally pleasant in winter but the nights can be very cold. The high mountains shield the valley from the prevailing weather conditions. This has the advantage that Saas-Fee can offer skiing on the glacier in summer, but has the disadvantage that during the winter, the sun only reaches the Saas-Fee slopes from mid-february.

Population: 1,636

Total area: 40.6 km

Height: 1,800 meters above sea level

Ski area: 100 m of slopes up to an altitude of 3,600 m, maximum snow reliability

Tourism: 2017/18 almost 600,000 in Saas-Fee and 1 million overnight stays in the region

Climate

In a recent report Savills ranked ski resorts in a “Ski conditions resilience index”. Out of 55 resorts Saas-Fee is listed second after Zermatt. This report assesses the future of ski resorts in the world based on the effects of global warming. It defines the league of the best placed resorts to maintain quality of skiing in the world. In the same list resorts like St. Anton and Val d’Isère are in the bottom 20. The altitude and snow guarantee is one of the major factors.

Destination Saas-Fee

Inhabitants

In 1850, Saas-Fee only counted 233 inhabitants in this far most corner of the Alps.

Today Saas-Fee has 1’600 citizens since the last census in 2013 and has remained stable since.

During Christmas, carnival or Easter the number can swell up to a mid-sized town of over 12’000

Political system

Leading party is the CVP, the Christian Democratic Peoples party. Saas-Fee is governed by a municipal council with 5 members which represents the executive power of the village.

Further to this council there are several committees which assist the council in an advisory capacity and delivers the basics for projects and ideas.

The most important commission is the building commission and the traffic commission. The last election of the village council took place in 2012. Voters must be “Burger” of Saas-Fee and have the special “birth right”. This group consists of only around 900 citizens of Saas-Fee.

This group is also entitled to vote on laws and regulations concerning the village politics (i.e. the village tax raise of 2016, building permits).

Ski-area and more…

There are 100km of groomed ski runs for every kind of skier and all abilities. Besides skiing, a wide range of activities is available in Saas-Fee throughout the year. Most of these are run by the tourism board of the destination. They can be found on the homepage of the tourism board. Unfortunately, this is not marketed well by the service providers. The best-known initiatives are the WinterCard (2016) and the Magic Pass (2019).

Saas-Fee has a great destination marketing potential (externally). Internal difficulties are presented positively to the outside world, e.g. with the Citizen Pass and the Saas Pass. Sadly, there is a lot of division between the service providers. As a result any good external visibility may fizzle out internally because there is no common base.

Considering its size, the destination Saas-Fee offers a large number of hotels (60) in all categories. Three-star hotels make up the majority, closely followed by two-star hotels. There are 8 four- and 2 five- star hotels.

In addition, a number of holiday apartments are available, but most of them offer a below-average quality standard. Saas-Fee rightly belongs to the top of the Alpine holiday destinations, but the value of the “Saas-Fee brand” is gradually falling due to the lack of positive news from the destination marketing and STB. However, this may change in the short-term both at the destination marketing and STB.

Guest Mix & Overnights

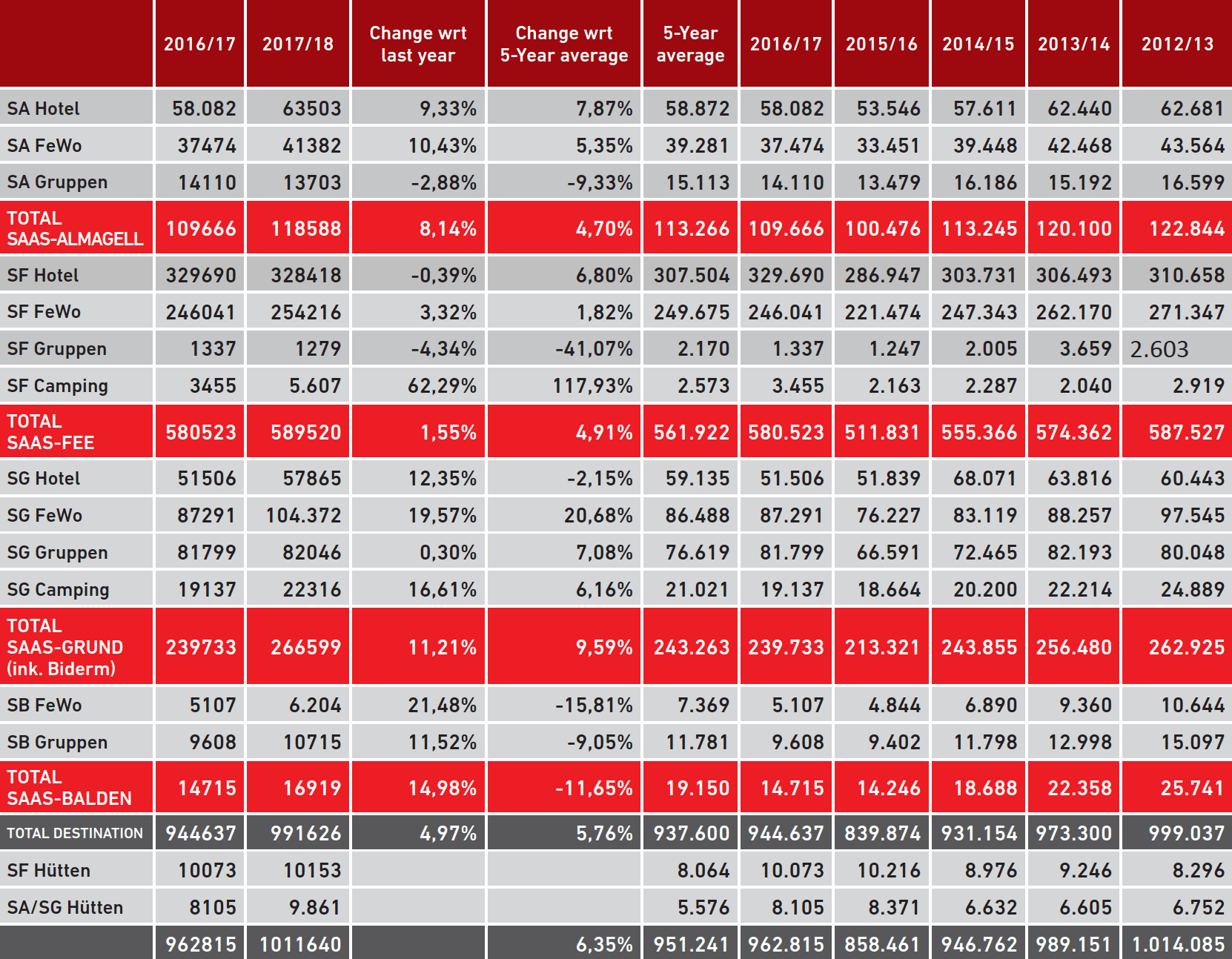

The development of overnight stays shows that the loss of stays was recovered for the most part. It also shows the potential of the destination.

Saas-Fee shows a clear peak in guest numbers during Christmas and New Year, February and March. In this region the winter season starts late, the 15th of December. Guests in November are mainly ski testers, who take the opportunity to ride new ski models. This activity bears great potential as many Swiss guests take advantage of this.

April depends on the Easter holidays. When Easter is too late in the season, guests don’t return for skiing but rather choose warmer destinations for travel.

Swiss guests

Swiss guests

The Swiss represent 54 % of the guests. This can be interpreted as good or less so, depending on the state of the economy. Particularly during economically weak periods, Swiss guests are loyal to their homeland and in this case, the above percentage would be considered too low. The proportion of Swiss guests is significantly higher in Saas-Fee than in the other SaasTal villages, since the Swiss like to be at the centre of the action.

![]() German guests

German guests

With a share of 13.95 %, the Germans make up the largest group after guests from Switzerland. The percentage of German guests in Saas-Fee is about 66% of the whole valley.

Dutch guests

Dutch guests

Guests from the Netherlands make up 5,73 %. It is quite surprising that this group of guests lags behind those from the UK. At the same time, the Dutch prefer Saas-Grund to Saas-Fee.

Based on the overnight stay statistics, the marketing focus needs to be targeted at these markets:

■ Switzerland

■ Germany

■ Netherlands

■ UK

■ Benelux (see 3.4 Guest Mix)

In addition to the existing marketing efforts by the TO/STAG, the Dom Collection has discovered and expanded other marketing channels over the past five years. It is essential to identify the exact break even point between costs and revenue for each room to ensure successful marketing. That way, the offer is neither over nor under priced for tour operators and wholesalers but will generate sufficient mass to guarantee a reasonable annual occupancy and good RevPAR.

Cable Car

120 km of slopes. New major owner with Family Schröcksnadel, owner of the “Vereinigte Bergbahnen” with 10 ski resorts in Europe.

The SAASTAL BERGBAHNEN (STB) has plans to double the current ski area by expanding towards Italy. In summer 2016/17 the Spielboden cable car was replaced and to make further improvements, a significant capital increase was needed. Edmond Offermann made an offer to provide this capital, if he was allowed to obtain a 51% controlling stake in the STB. Saas-Fee, not in favour of giving the control to one person, turned this offer down. One year later, Saas-Fee accepted a similar offer under less favourable conditions by the Schröcksnadel group.

■ The SaasTal cable car urgently needs to be renovated. The municipality alone cannot meet the financial costs. The Schröcksnadel Group is now coming to Saas-Fee and will receive two seats on the supervisory board, one each for Peter and Markus Schröcksnadel.

Peter Schröcksnadel has been president of the Austrian Ski Association ÖSV for 28 years, his son Markus is his designated successor. Since their arrival in October 2018, the financial situation has greatly improved and a clear strategy for the future is being implemented. Statement by Schröcksnadel: “As a ski-loving family, we particularly like the absolute snow guarantee that Saas-Fee can offer.

We are delighted to be working with Saas-Fee to further develop this unique location. The aim is to acquire a majority stake in the SaasTal Bergbahnen AG in the coming two years.”

■ Peter Schröcksnadel is Director of Sitour Management GmbH, part of the Feratel Group. Feratel Media Technologies GmbH in Innsbruck is today one of the leading international developers and providers of tourism information systems (panorama television, hotel cards, info terminals, booking solutions, etc. ).

His son, Dr. Markus Schröcksnadel (SM Holding GmbH in Rum), is Managing Director of Vereinigte Bergbahnen GmbH. The family group also includes SV Beteiligungs GmbH and VB-HIWU Beteiligungs GmbH in Innsbruck (holdings in the tourism infrastructure). Sitour Management and the United Cablecars “Vereinigte Bergbahnen” hold a number of ski resorts and tourism companies:

■ 80 % in Großglockner Bergbahnen Touristik GmbH

■ 50 % in Großglockner Hotel und Infrastruktur (GBT Ski-Holding GmbH in Heiligenblut)

■ 100 % in Patscherkofelbahnen GmbH (1996-2014)

■ 100 % in Ötscherlift-Gesellschaft GmbH & Co KG

■ 99 % in Unterberghornbahnen Kössen GmbH & Co KG

■ 53 % in Hinterstoder-Wurzeralm Bergbahnen AG

■ 50 % in Hochficht Bergbahnen GmbH

■ 51 % in Hochkar Bergbahnen GmbH

■ 60 % in Kasberg-Bahnen HWB-Betriebs GmbH

In addition to his activities as president of the ÖSV, Peter Schröcksnadel is Managing Director of four subsidiaries of the ÖSV, namely Austria Skiteam Handels und Beteiligungs GmbH, Austria Ski Nordic Veranstaltungs GmbH, Austria Ski WM und Großveranstaltungs GmbH and Austria Ski Veranstaltungs GmbH.

Competitor Set

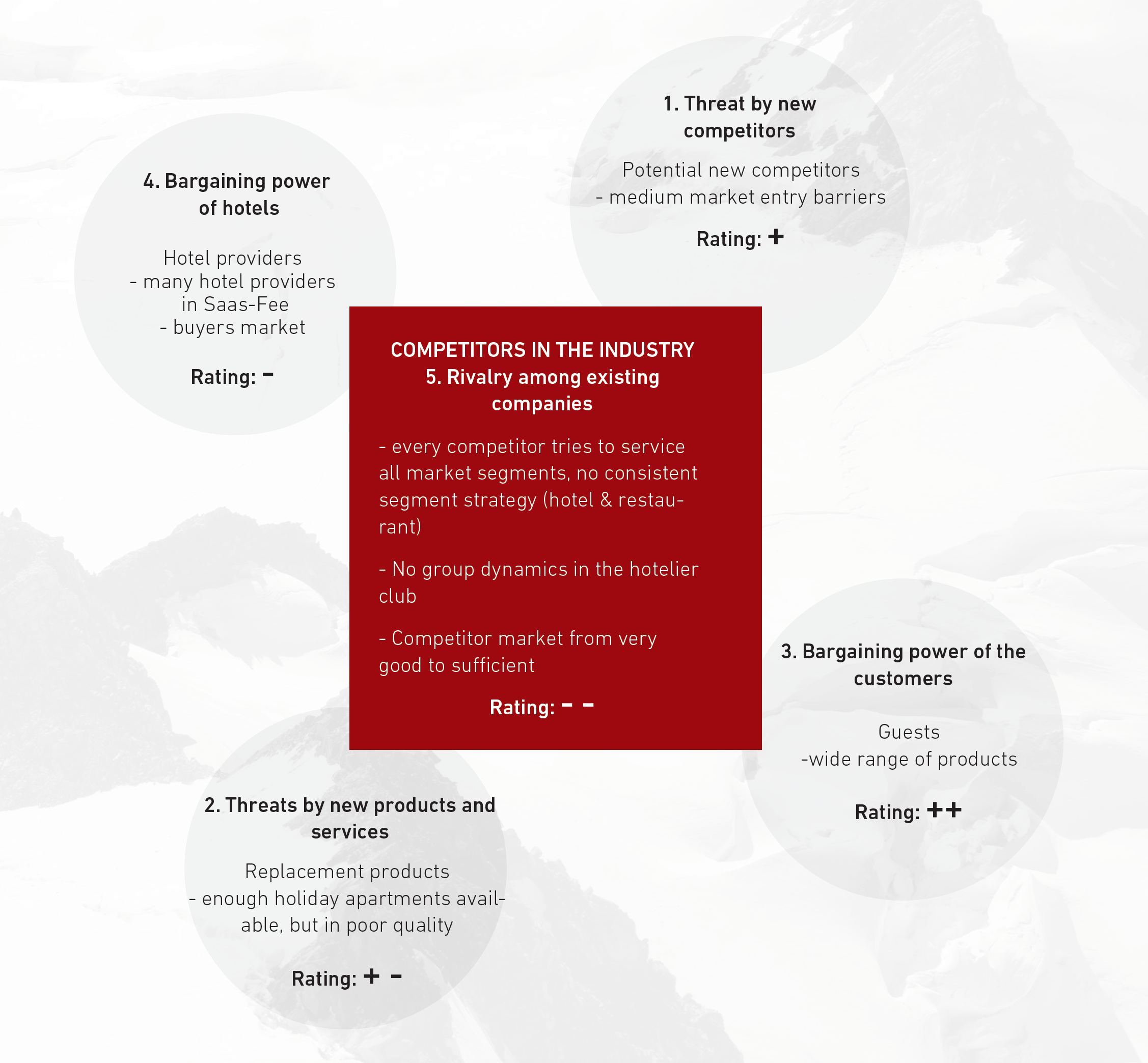

Analysis of the industry

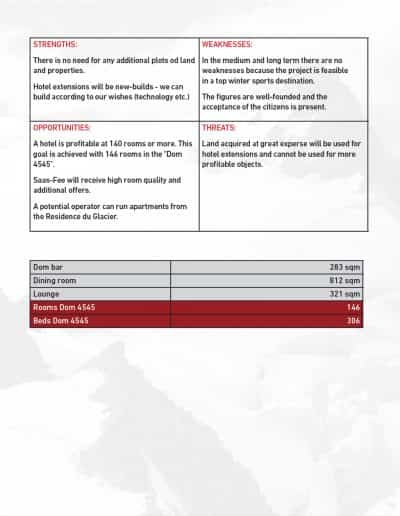

The future project “Saas-Fee Centrum” is part of the hospitality services industry. The following is an evaluation of the industry attractiveness (hotels, gastronomy and apartments) and its development in Saas-Fee.

Besides hotels and gastronomy, the hospitality industry also includes holiday accommodation, which is partly provided professionally and in part on a semi-professional basis.

According to Porter, the weighting of the accommodation market is broken down as follows:

At the moment, Saas-Fee is a buyers market, until the “driver” (i.e. STB etc.) presents new innovations. For example, there is currently an oversupply of hotel rooms, even in winter. Apart from a few exceptions, the current quality standard of the hotels is no longer up-to-date and hardly conducive to bringing back tourists. The apartment infrastructure is not very well organised, and many are not in very good condition. Otherwise, this sector would have a much larger impact on the accommodation market than it currently has. At the moment, the entire hospitality industry is comatose and waiting for an initial spark from the STB and its new owner, to bring it back to life. It is also reliant on massive support from SaasTal Marketing AG. Very few owners of hotels or holiday apartments put effort into their own continuous marketing and no longer have sufficient capital to keep their objects in a good condition.

Given the current market conditions, hotels with a good product and the necessary capital for marketing have the opportunity to take advantage of the predatory competition conditions and be well positioned in the future. There are already some trends showing movement in the hotel market. Some new investors are believing in the development of Saas-Fee, like the Hedge Fund Manager George Papamarkakis with his brand new 5* Hotel The Capra (www.capra.ch) or a company based in Zürich, which bought the FerienArt Hotel. Presently they are doing a 100% renovation for approximately MCHF 12 and will convert the product to “The Grand Hotel Walliserhof” in Saas-Fee (www.walliserhof-saasfee.ch). Furthermore, Swedish and Austrian investors are entering the market, but most of the hotels are being converted into apartment hotels.

The market in detail

Hotel market:

Information provided by STAG gives a complete picture of the entire hotel market in the SaasTaI.It shows decreases in 2011 and 2015 (pages 43 and 44), while other winter destinations had light increases. The hotel market is changing in Saas-Fee, more hotels will be converted into apartments in 2019. In the last 7 years 28% (317 hotel rooms) have disappeared from the market. Another 60 hotel rooms are up for discussion regarding conversion to apartments.

Holiday rentals

There are 1,029 holiday apartments in Saas-Fee, rated according to STF criteria. The majority (601) is 2-star accommodation, followed by 302 with 3 stars. There are very few good high-end apartments and chalets. The WinterCard was a lifeline for the dying apartment business in Saas-Fee. Since years modern apartments are missing in Saas-Fee. Presently the following hotels will be converted into apartments bringing even further pressure on this market segment:

■ Metropol (conversion in 2019)

■ Britannia (conversion in 2019)

■ Alpin (conversion in 2019)

■ Berghof (conversion 2020)

■ Elite (conversion TBA)

These conversions can also be a good chance to raise the quality of holiday apartments in Saas-Fee if managed professionally to avoid cold beds in the destination.

Restaurants

Saas-Fee has a large number of restaurants to offer. There is something for every taste and nearly every pocket. In Saas-Fee, a Michelin-star restaurant is missing, probably because the current clientele mix can´t sustain such an option.

Competitors

The current competitors are looked at in detail under “competitor analysis”.

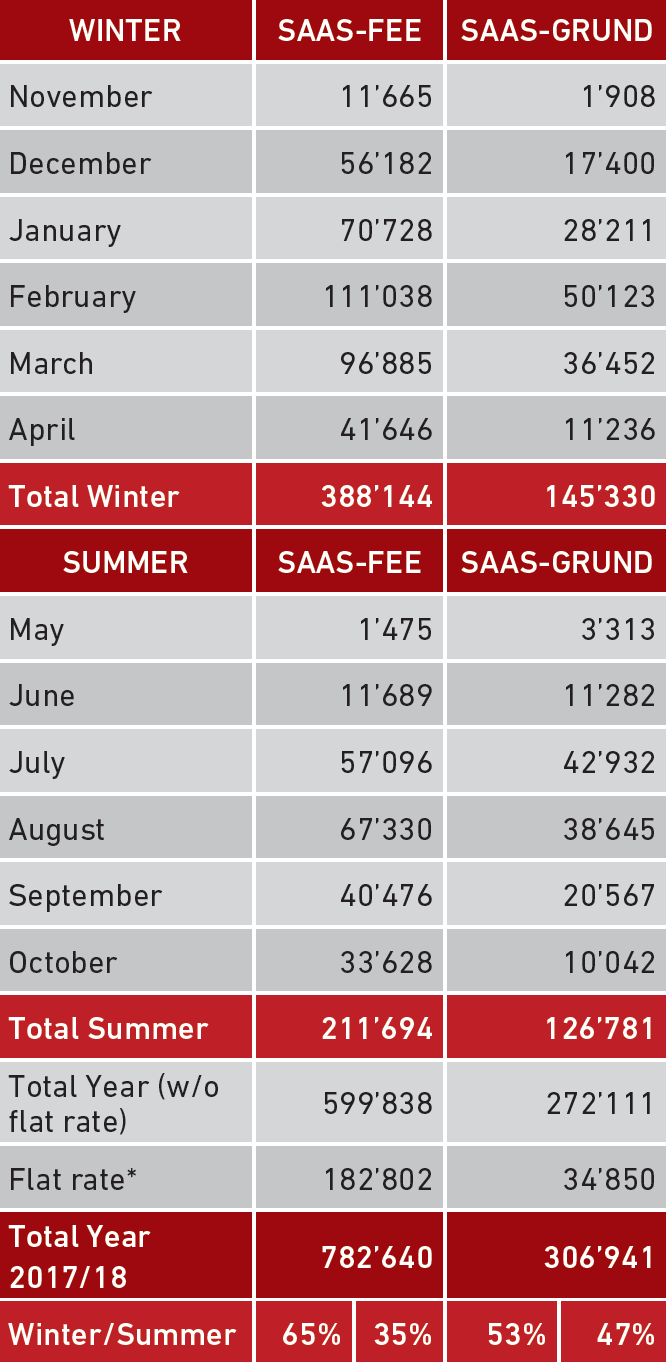

Times of operation

Saas-Fee is a seasonal business. The summer and winter seasons cover 8-10 months of the year. Most hotels and restaurants close during the off-season (April/May and October/November).

Times of Operation

The business of operating hotels and shops in Saas-Fee is highly seasonal.

The business of operating hotels and shops in Saas-Fee is highly seasonal. The Saas-Fee summer season runs from June to October and the winter season from December to mid-april. The structural change in the holiday sector and an extended range of products in neighbouring countries continue to weaken the traditional winter peak season. During summer, business is partly compensated by lowering rates and thus increasing the occupancy rate. A prime example are the Japanese groups visiting Saas-Fee in the summer. Most hotels and restaurants close during the off-season (April/May and October/November). Only a few restaurants stay open. Most of these either have a large summer terrace they can use early in the season or are staffed by family members.

Transport A

Arrival by plane:

Via Switzerland:

- Sion (SIR): 1 hour

- Geneva (GVA): 2.30 hours

- Zurich Kloten (ZRH): 3.30 hours

Via Italy:

- Milan (MXP): 2.30 hours

Transport B

Arrival by car:

- From Zurich to Saas-Fee: 4 hours

- From Geneva to Saas-Fee: 2.50 hours

- From Milan: 3.15 hours

Transport C

Arrival by train:

- Milan 5.10 hours

- Geneva 3.30 hours

- Zurich 3.20 hours

Video

Saas-Fee in 100 Seconds.

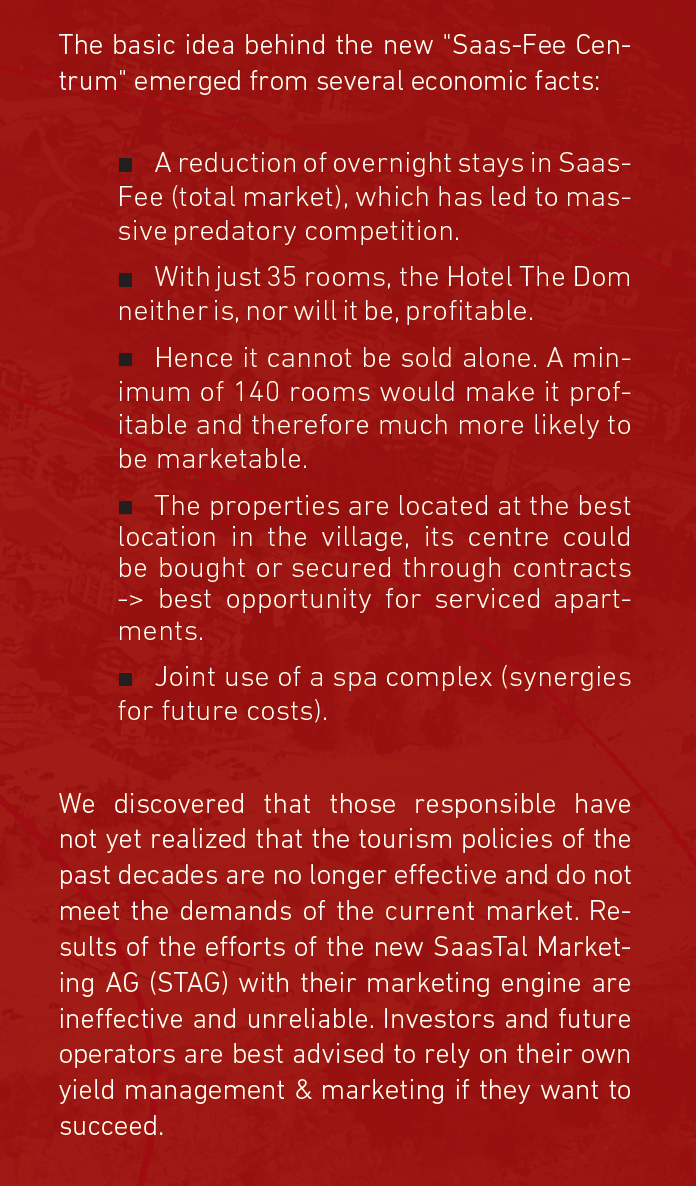

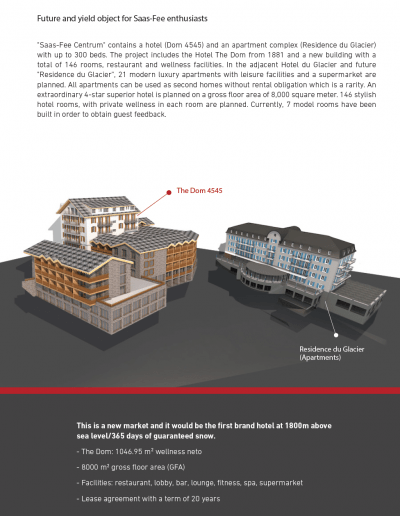

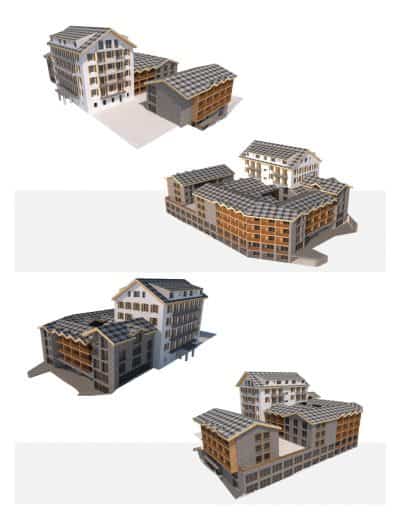

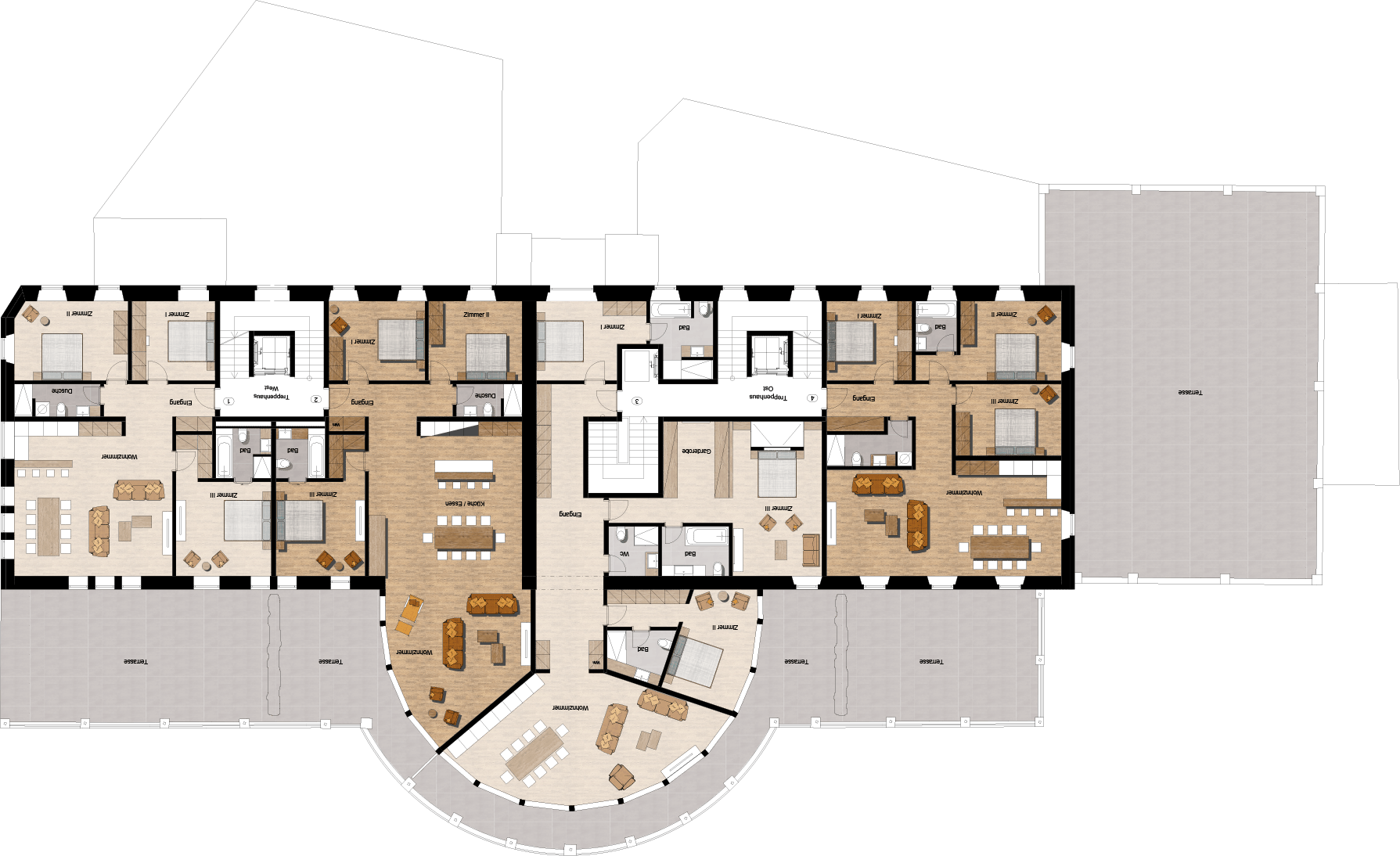

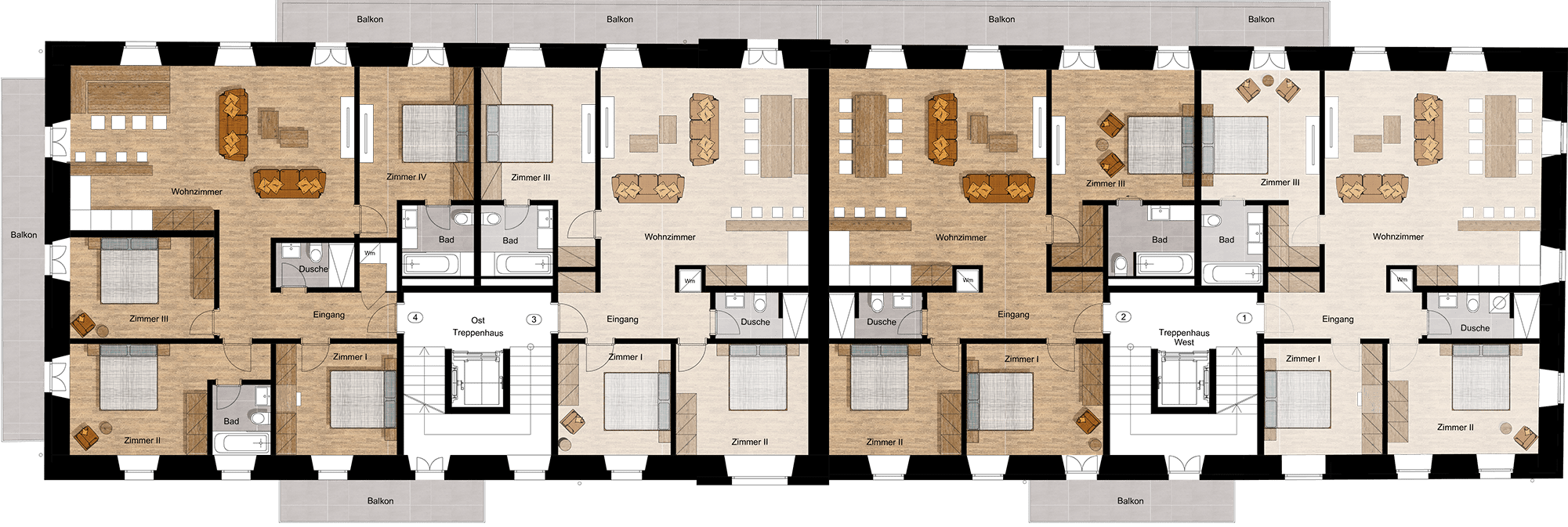

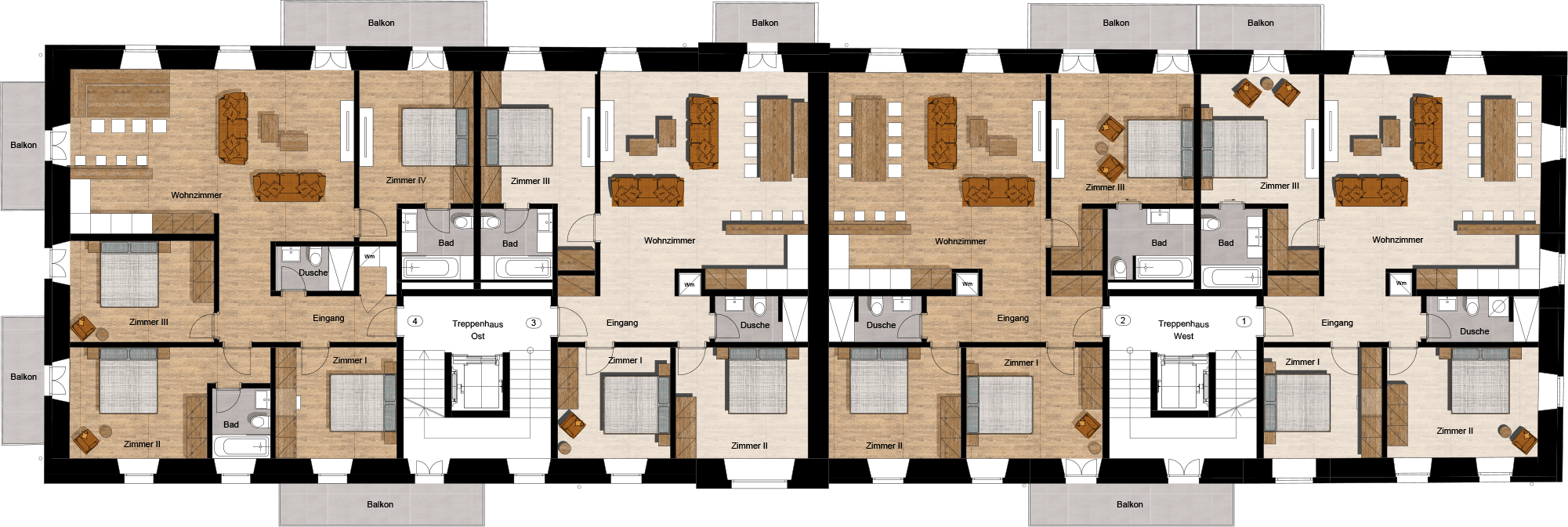

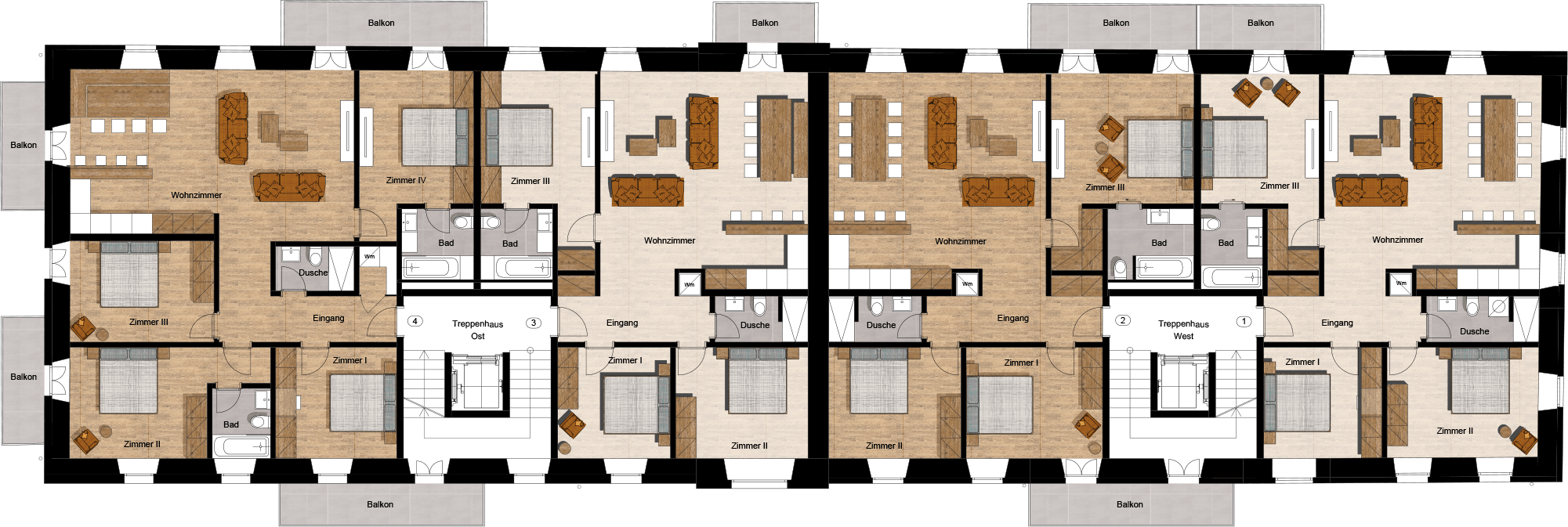

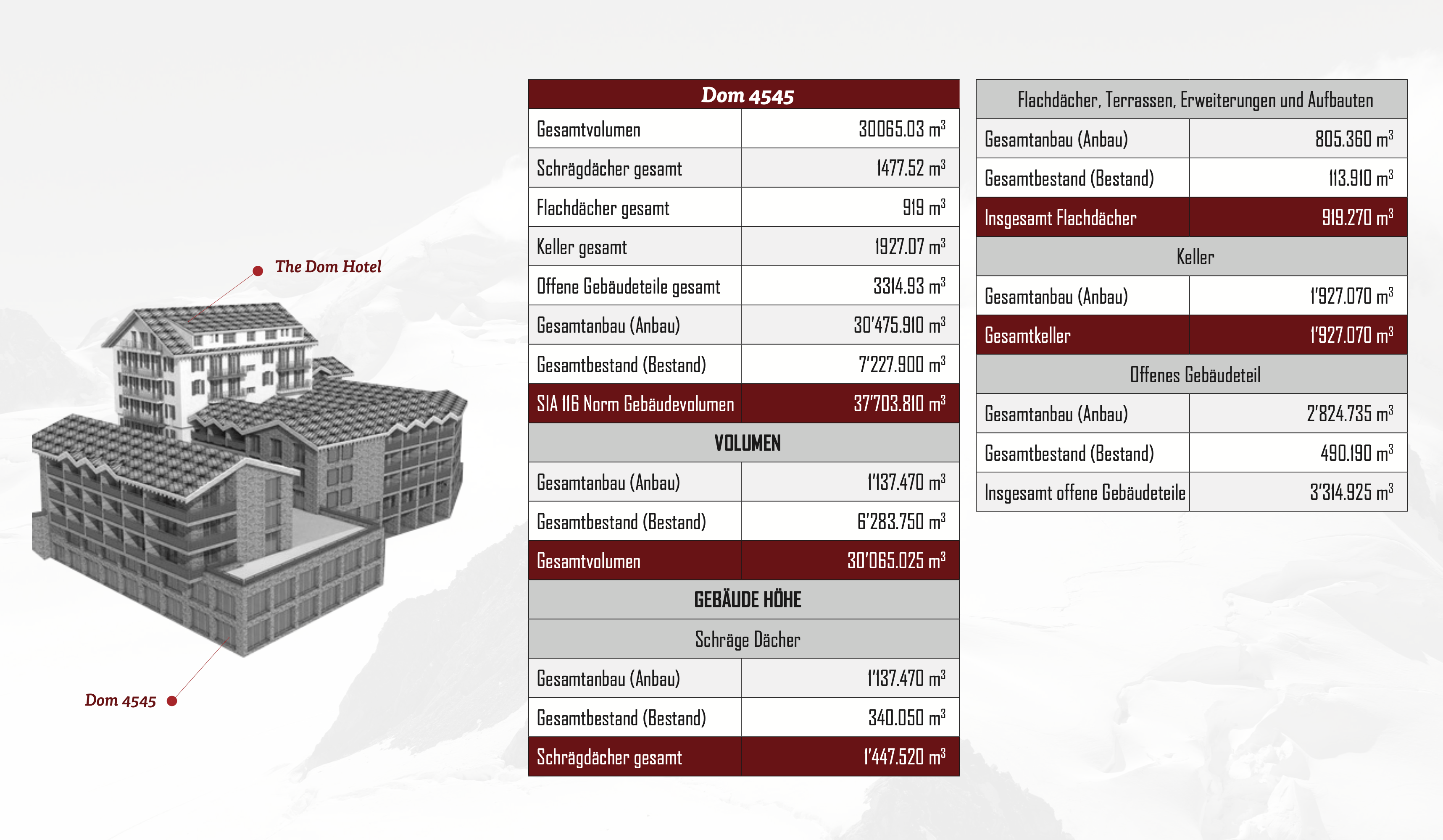

Dom 4545 Project

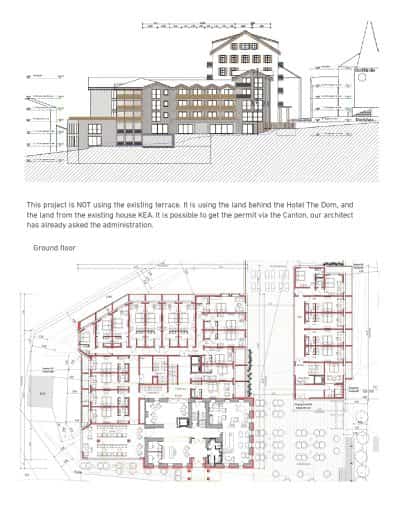

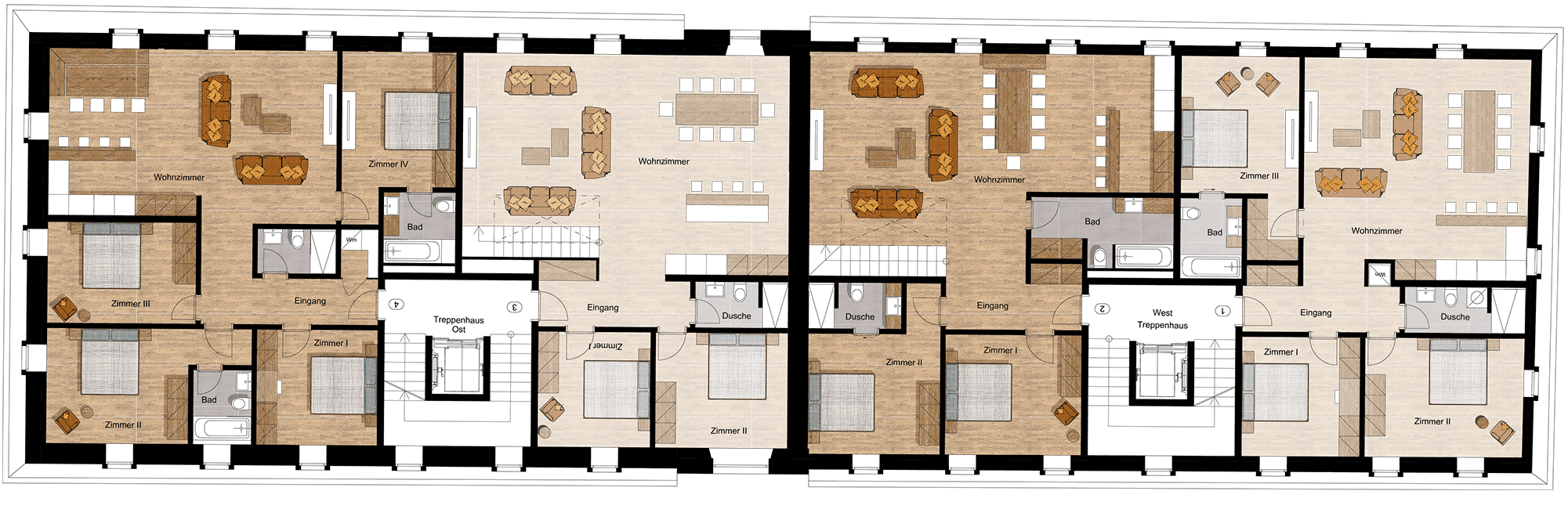

The idea behind the Dom 4545 project, it is to expand the existing The Dom Hotel to 135 rooms, in order to make the Hotel Dom Saas-Fee AG even more profitable. The new hotel will hold 135 rooms, 7 model rooms have been built already in order to obtain guest feedback.

Hotel

The project company is owned by the Dom and du Glacier hotels, both of which are located in the center of Saas-Fee and are now to be rebuilt or built at the same time as part of two projects.

Project “Dom4545” includes following projects:

Project “Dom 4545”

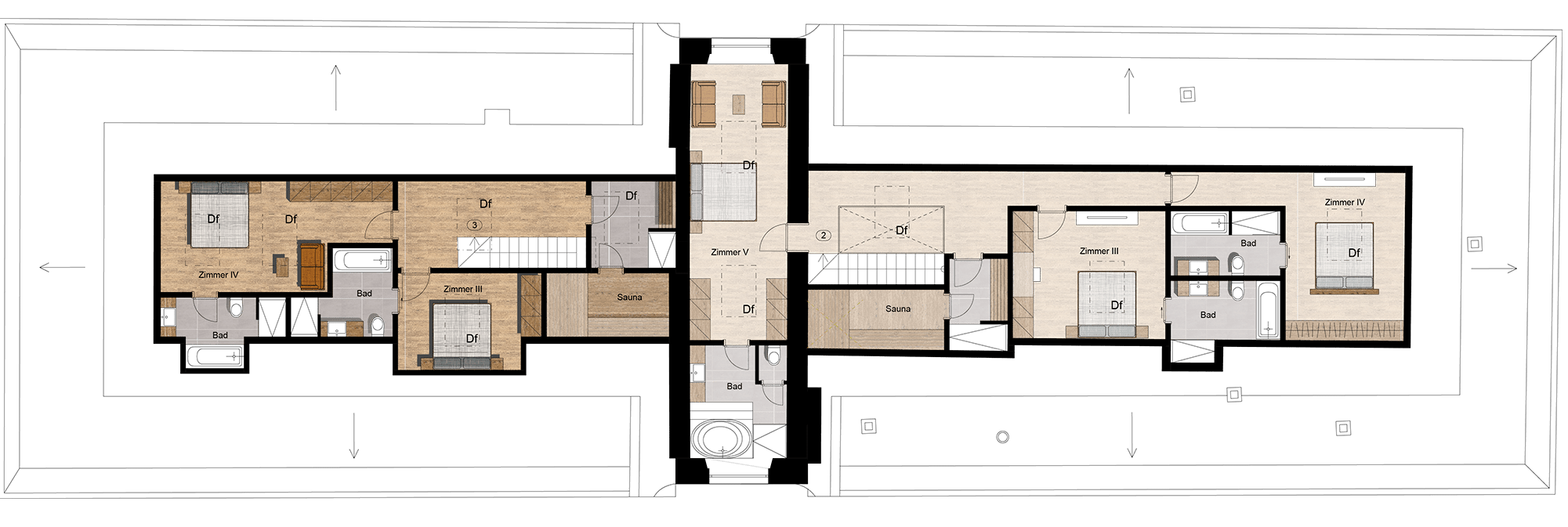

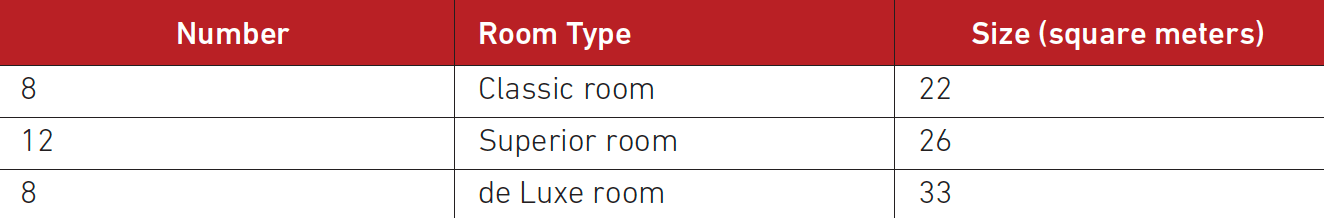

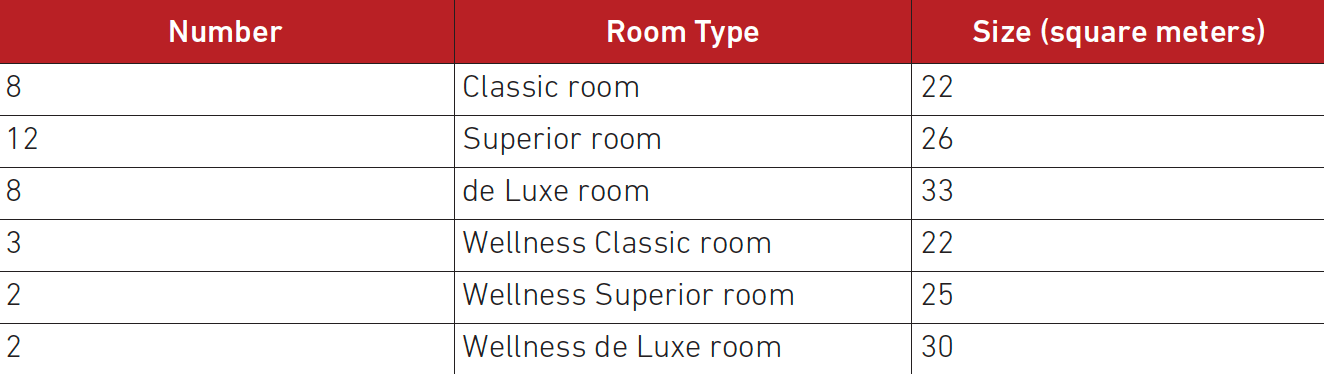

Refurbishment and expansion of the existing The Dom Hotel from 35 rooms to a first class hotel with 143 rooms and suites, catering, conference rooms and wellness.

We are now looking for an operator / patcher for the future hotel.

Project “Residence du Glacier”

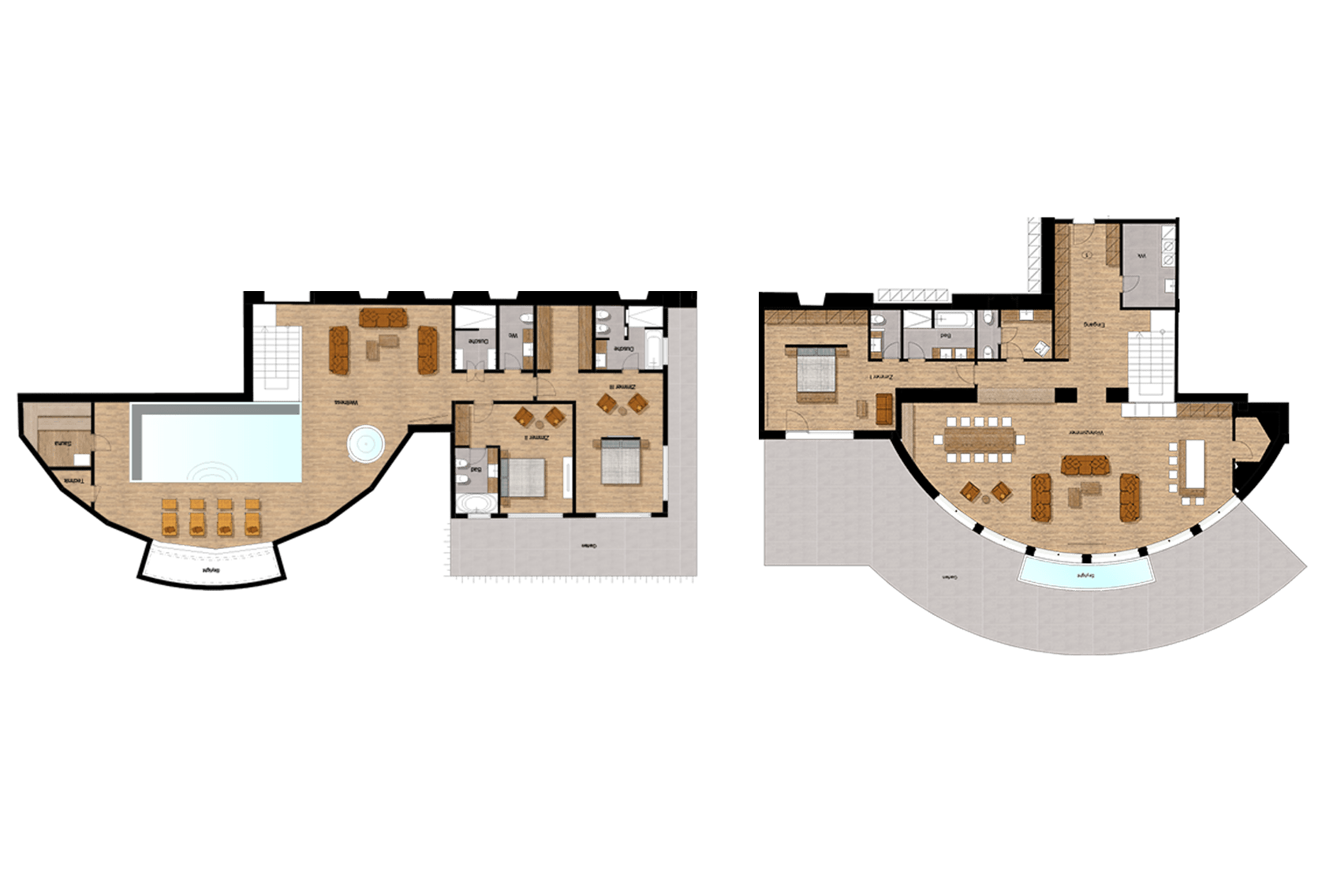

Conversion of the existing Hotel du Glacier into an apartment building with a second home.

This project is only of interest to the future operator / patcher of the Hotel The Dom insofar as the future apartment owners and possibly their tenants and guests may generate additional business for the hotel.

Service Apartments

In the adjacent Hotel du Glacier, 22 modern luxury apartments with 140 beds and a supermarket are planned. This is a UNIQUE constellation of the two properties. Hotel and service apartments.

Hotel du Glacier in the planing as “Residence du Glacier”. Due to the unique constellation of the two properties “The Dom” and “du Glacier” in the middle of Saas-Fee, the project enables usage figures to be exchanged from “The Dom” to “du Glacier” in relation to second homes.

Due to this special constellation, the premises of “Residence du Glacier” can serve as wonderful second homes by a 100%.

For a potential investor in “Dom4545”, the “Residence du Glacier” is a very promising additional business with a very high IRR and quick recapitalisation. With conservative planning, the IRR is a remarkable 27%.

In the project “Residence du Glacier” there are 22 high-standard apartments planned, on a gross floor area of 2328.91m2.

The first project sketches show the great possibilities of redesigning the du Glacier building.

The Dom – Present State

The Dom Hotel was built in 1881 as the first Hotel in Saas-Fee. By 2011 it was badly run down by the owner family and was about to be closed due to non-compliance with fire regulations.

In 2012 / 2015 , completely refurbished the hotel with 35 rooms, ballroom and restaurant and built in a bar which can double as a shop and coffee shop, while leaving the old charm infused in a modern and contemporary design.

The current Hotel The Dom has only 35 rooms and cannot be run profitably despite its high quality. Since May 2013, the management has been taking steps to bring the hotel to a size that will be sufficient to make it profitable.

The 2016 construction of the 5th floor was a test in building techniques, design and incorporation of ‘personal wellness’ into hotel rooms. They also serve now as prototypes for the proposed refurbishment of the du Glacier and as a model for the apartments in the future “Residence du Glacier”. Over the past 3 years the plan for expanding the Dom Hotel to 100 rooms went through several iterations in order to fulfill the local building code while maintaining the number of rooms.

The new rooms have been named “Wellness” because every bathroom is like a mini spa with a steam room and rainfall shower, aroma- and light therapy spa system by Starpool. The spa theme was also carried into the interior design.Despite the high quality of the Hotel The Dom and its rooms, it is not possible to run the hotel profitable in its current management structure (not a family run hotel). The number of rooms targeted remains 100, so that the object will be of interest to hotel groups. The investor’s aim is to sell the project off-plan or following delivery.

Dom 4545 Project – Facts

Rooms, with room size from 25,27 sqm up to 58,63 sqm

Beds

sqm Wellness area

Total Area

Dom 4545 Project – Figures

Occupancy in %

CHF - AHR

MCHF - Total rooms revenue

MCHF - Total F&B revenue

MCHF - Total revenue

GOP in %

NOP in %

Staff Cost in %

Additional revenue, due to service apartments

Additional revenue by CHF 284.000 with an apartment occupancy at 56%/ year.

Dom 4545 & du Glacier Residence Businessplan

Dom 4545 Project – LOI

Contact us

Let us know if you have any questions!